A firm has a wacc of 8.5 percent – A firm’s Weighted Average Cost of Capital (WACC) at 8.5 percent presents a captivating subject for exploration. This metric, which represents the average cost of a firm’s financing, holds significant implications for its capital budgeting and investment decisions. In this discourse, we delve into the concept of WACC, its components, calculation methods, influencing factors, and practical applications, providing a comprehensive analysis that empowers readers to grasp its significance in modern financial management.

Understanding Weighted Average Cost of Capital (WACC)

Weighted Average Cost of Capital (WACC) is a crucial concept in capital budgeting that represents the average cost of capital raised by a firm from various sources, such as debt and equity. It is a critical factor in evaluating investment projects and making capital budgeting decisions, as it determines the minimum acceptable rate of return for a project to be considered viable.

Formula for Calculating WACC

The formula for calculating WACC is as follows:“`WACC = (E/V) x Re + (D/V) x Rd x (1

Tc)

“`where:

- E is the market value of the firm’s equity

- V is the total value of the firm (E + D)

- Re is the cost of equity

- D is the market value of the firm’s debt

- Rd is the cost of debt

- Tc is the corporate tax rate

Components of WACC

Weighted Average Cost of Capital (WACC) is a calculation that combines the cost of debt and the cost of equity to determine the overall cost of capital for a firm. Understanding the components of WACC is essential for making sound financial decisions.

Cost of Debt

The cost of debt is the interest rate that a firm must pay on its borrowed funds. It is typically calculated as the yield to maturity (YTM) on the firm’s outstanding debt.

Cost of Equity

The cost of equity is the return that investors expect to receive on their investment in the firm’s stock. It is typically estimated using the Capital Asset Pricing Model (CAPM) or the Dividend Discount Model (DDM).

Calculating WACC

Calculating WACC is a crucial step in evaluating the cost of capital for a firm. It involves determining the weighted average cost of all sources of capital, including debt and equity. By considering the cost of each capital source and its proportion in the firm’s capital structure, WACC provides a comprehensive measure of the overall cost of capital.

To calculate WACC, follow these steps:

- Determine the cost of debt (rd): This is the annual interest rate paid on outstanding debt, adjusted for taxes. It can be calculated as follows:

- rd= (Interest expense) / (Debt outstanding) x (1

Tax rate)

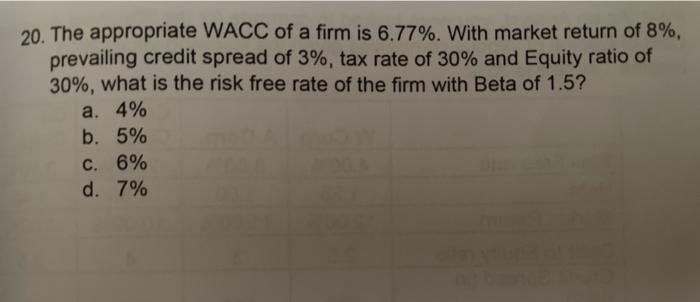

- Determine the cost of equity (re): This is the expected return required by equity investors. It can be estimated using the Capital Asset Pricing Model (CAPM):

- re= r f+ β x (r m

rf)

- where:

- r f= Risk-free rate

- β = Beta of the firm’s stock

- r m= Expected market return

- Calculate the debt ratio (D) and equity ratio (E):These ratios represent the proportion of debt and equity in the firm’s capital structure. They can be calculated as follows:

- D = Debt outstanding / (Debt outstanding + Equity value)

- E = Equity value / (Debt outstanding + Equity value)

- Calculate the WACC:Finally, the WACC is calculated as the weighted average of the cost of debt and the cost of equity, using the debt ratio and equity ratio as weights:

- WACC = D x rd+ E x r e

For example, consider a firm with the following information:

| Debt ratio (D) | Debt cost (rd) | Equity ratio (E) | Equity cost (re) |

|---|---|---|---|

| 0.6 | 8% | 0.4 | 12% |

Using the formula, the WACC for this firm is calculated as:

WACC = 0.6 x 8% + 0.4 x 12% = 9.6%

Therefore, the firm’s overall cost of capital is 9.6%. This information can be used to evaluate investment decisions and assess the financial performance of the firm.

Factors Affecting WACC: A Firm Has A Wacc Of 8.5 Percent

The weighted average cost of capital (WACC) is a crucial metric that reflects the cost of capital for a firm. Several factors can influence the WACC, including the firm’s capital structure, debt-to-equity ratio, and risk profile.

Capital Structure

The capital structure of a firm refers to the proportion of debt and equity financing used to fund its operations. A higher proportion of debt financing typically leads to a lower WACC due to the tax deductibility of interest payments.

However, excessive debt can increase the firm’s risk profile, potentially offsetting the tax benefits and leading to a higher WACC.

Debt-to-Equity Ratio

The debt-to-equity ratio measures the relative use of debt and equity financing. A higher debt-to-equity ratio indicates a greater reliance on debt, which can increase the firm’s financial leverage and risk. As a result, a higher debt-to-equity ratio can lead to a higher WACC.

Risk Profile, A firm has a wacc of 8.5 percent

The risk profile of a firm reflects its exposure to various risks, such as business risk, financial risk, and market risk. Firms with higher risk profiles typically have higher WACCs as investors demand a premium for bearing additional risk. Conversely, firms with lower risk profiles tend to have lower WACCs.

Applications of WACC

Weighted Average Cost of Capital (WACC) is a crucial metric used in corporate finance to assess the cost of capital raised from various sources, such as debt and equity. It plays a significant role in several financial decision-making processes, including capital budgeting, investment appraisal, and dividend policy.

WACC is a critical tool for evaluating investment opportunities. By comparing the WACC with the expected return on an investment, companies can make informed decisions about whether to proceed with the investment. If the expected return exceeds the WACC, the investment is considered profitable and vice versa.

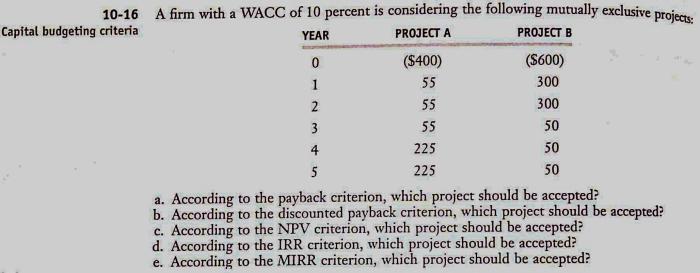

Capital Budgeting

WACC is widely used in capital budgeting to assess the viability of long-term investment projects. Companies evaluate the cost of capital against the expected cash flows generated by the project. If the project’s internal rate of return (IRR) exceeds the WACC, it is deemed financially feasible and can be undertaken.

Investment Appraisal

WACC is also employed in investment appraisal to assess the attractiveness of potential investment opportunities. By comparing the WACC with the expected return on investment, companies can determine whether the investment is worthwhile. If the expected return exceeds the WACC, the investment is considered favorable.

Dividend Policy

WACC is considered when determining a company’s dividend policy. Companies must balance the interests of shareholders (who desire dividends) with the need to retain earnings for growth and investment. By comparing the WACC with the cost of issuing new equity, companies can determine the optimal dividend payout ratio.

Limitations of WACC

WACC, while a useful tool for evaluating capital costs, has certain limitations that users should be aware of.

One limitation of WACC is its reliance on assumptions. The calculation of WACC requires the estimation of the cost of debt and equity, which can be subject to change based on market conditions and other factors. These assumptions can introduce uncertainty into the WACC calculation, potentially affecting the accuracy of the results.

Alternative Methods

Alternative methods for evaluating capital costs can complement WACC and provide additional insights into a firm’s financing options.

- Cost of Equity:The cost of equity can be estimated using the Capital Asset Pricing Model (CAPM), which considers the risk of the equity investment relative to the overall market.

- Cost of Debt:The cost of debt can be estimated using the yield-to-maturity (YTM) of the firm’s outstanding debt or by examining comparable debt instruments with similar risk profiles.

- Weighted Average Marginal Cost of Capital (WAMCC):WAMCC considers the incremental cost of raising new capital, taking into account the specific sources and amounts of financing being considered.

FAQ Overview

What is the significance of WACC in capital budgeting?

WACC serves as a discount rate for evaluating potential investment projects, ensuring that firms allocate capital to those with positive net present values, maximizing shareholder wealth.

How does a firm’s capital structure impact its WACC?

A firm’s capital structure, which represents the proportion of debt and equity financing, directly influences its WACC. A higher debt ratio typically leads to a higher WACC due to the higher cost of debt compared to equity.

What are the limitations of using WACC?

WACC relies on assumptions and may not capture all sources of financing, such as convertible debt or hybrid securities. Additionally, it assumes constant proportions of debt and equity, which may not always hold true.